Introduction

Traders are always on the lookout for the slightest edge that can turn a profit. One crucial aspect that can provide this edge is understanding the dynamics of the Limit Order Book (LOB). The LOB, a record of outstanding orders for a particular asset, is the heart of most modern electronic exchanges. It’s a bustling marketplace where buyers and sellers continuously adjust their bids and offers, reacting to the ebb and flow of the market.

But there’s more to the LOB than meets the eye. Beneath the surface, imbalances in the LOB can signal potential trading opportunities. These imbalances, differences between the number of buy and sell orders at a given price level, can provide insights into the market’s future direction. But how can traders detect these imbalances? And more importantly, can these imbalances be used to make profitable trading decisions?

In this article, we’ll explore these questions in depth. We’ll dive into recent academic research that has investigated the potential of LOB imbalances as a trading signal. We’ll dissect these studies, understanding their methodologies, dissecting their results, and drawing out their conclusions. Our journey will take us through the intricacies of trade arrival dynamics, the price impact of order book events, and the predictive power of queue imbalances.

But we won’t stop at theory. We’ll also showcase a practical tool, VisualHFT, that brings these academic insights to life. VisualHFT is a powerful GUI for high-frequency trading systems, designed to visualize market microstructure analytics in real-time. One of its key features is real-time LOB imbalance charts, a feature that can help traders leverage the insights from the research we’ll discuss.

So, whether you’re a seasoned trader looking for the next edge, a researcher interested in the latest developments in LOB dynamics, or a curious observer eager to understand the world of high-frequency trading, this article has something for you.

Understanding LOB and Its Imbalances

A LOB is essentially a list of buy and sell orders for a specific asset, organized by price level. It’s a real-time snapshot of market demand and supply. On one side of the book, you have ‘bids’ – these are buy orders, showing the price traders are willing to pay and the quantity they want to buy. On the other side, you have ‘asks’ – sell orders, showing the price at which traders are willing to sell and the quantity they’re offering.

The LOB is continuously updated as new orders come in, existing orders are filled, or traders cancel their orders. It’s a dynamic, ever-changing landscape that reflects the collective actions and intentions of market participants.

Now, let’s talk about imbalances. In a perfectly balanced market, the number of buy orders would match the number of sell orders. But markets are rarely perfectly balanced. At any given moment, there might be more buy orders than sell orders, or vice versa. This is what we call an ‘imbalance’ in the LOB.

Why are these imbalances important? Well, they can provide insights into market sentiment. For example, if there are significantly more buy orders than sell orders at a particular price level, it could indicate bullish sentiment – a belief among traders that the asset’s price will rise. Conversely, if there are more sell orders, it could signal bearish sentiment – a belief that the price will fall.

But can these imbalances be used as a trading signal? Can they help traders predict price movements and make profitable decisions? That’s the million-dollar question – and it’s the question that the research papers we’re about to discuss have tried to answer.

In the next sections, we’ll delve into these studies, dissecting their methodologies, results, and conclusions. We’ll start with a paper that looks at the relationship between trade arrivals and quote imbalance in a LOB. So, let’s get started.

Trade Arrival Dynamics and Quote Imbalance in a Limit Order Book

Let’s start our exploration with the paper Trade arrival dynamics and quote imbalance in a limit order book by Alexander Lipton, Umberto Pesavento, and Michael G Sotiropoulos. This study takes a deep look at the dynamics of the bid and ask queues of a LOB and how they interact with the intensity of trade arrivals.

The authors focus on the probability of price movements and trade arrivals as a function of the quote imbalance at the top of the LOB. In other words, they’re interested in how the imbalance between buy and sell orders at the best prices can affect the likelihood of trades happening and prices changing.

To do this, they propose a stochastic model. A stochastic model is a fancy term for a mathematical model that includes some element of randomness. It’s a way of capturing the inherent uncertainty and variability in financial markets.

This model is designed to capture the joint dynamics of the top of the book queues and the trading process. It’s a complex task, but the authors describe a semi-analytic approach to calculate the relative probability of different market events.

The model is then calibrated using historical market data. Calibration is a crucial step in any modeling exercise. It’s about adjusting the model’s parameters so that its outputs match observed data as closely as possible.

So, what do they find? The authors discuss the quality of fit and practical applications of the results. They find that the model can indeed capture some of the dynamics of the LOB and the trading process. The results suggest that the quote imbalance at the top of the LOB can indeed provide valuable information about the likelihood of price movements and trade arrivals.

This study provides a solid foundation for our understanding of LOB imbalances. It shows that these imbalances can have a significant impact on market dynamics and can potentially be used as a trading signal. However, as with any model, it’s an approximation of reality and comes with its own set of assumptions and limitations.

In the next section, we’ll look at another study that takes a different approach to understanding the impact of LOB imbalances.

The Price Impact of Order Book Events

Moving on, we turn our attention to the paper The Price Impact of Order Book Events by Rama Cont, Arseniy Kukanov, and Sasha Stoikov. This study takes a slightly different approach to understanding LOB imbalances, focusing on the price impact of different order book events.

The authors analyze the price impact of three types of order book events: limit orders, market orders, and cancellations. They use the NYSE TAQ data for 50 U.S. stocks, providing a broad and diverse dataset for their analysis.

One of the key concepts in this paper is the order flow imbalance. This is defined as the imbalance between supply and demand at the best bid and ask prices. In other words, it’s a measure of how much more buying or selling pressure there is at the top of the LOB.

The authors find that, over short time intervals, price changes are mainly driven by the order flow imbalance. This suggests that LOB imbalances can indeed be a powerful predictor of price movements.

But the insights don’t stop there. The study reveals a linear relationship between order flow imbalance and price changes. The slope of this relationship is inversely proportional to the market depth, meaning that the impact of imbalances is greater when the market is thin and less when the market is deep.

These results are robust to seasonality effects and are stable across different time scales and stocks. This suggests that the relationship between LOB imbalances and price changes is not just a quirk of a particular market or time period, but a fundamental feature of financial markets.

Interestingly, the authors argue that this linear price impact model, together with a scaling argument, implies the empirically observed “square-root” relation between price changes and trading volume. However, they also note that the relationship between price changes and trade volume is noisier and less robust than the one based on order flow imbalance.

This study provides further evidence of the potential of LOB imbalances as a trading signal. It shows that these imbalances can have a significant impact on price changes, especially in thin markets.

In the next section, we’ll look at yet another study that investigates the predictive power of queue imbalances in a LOB.

Limit Order Book as a Market for Liquidity

The next paper we’ll discuss is Limit Order Book as a Market for Liquidity by Thibaut Mastrolia and Angelo Ranaldo. This study takes a unique approach to understanding LOB imbalances, focusing on the liquidity aspect of the market.

The authors propose a new measure of liquidity that is based on the LOB. They argue that traditional measures of liquidity, such as the bid-ask spread or trading volume, do not fully capture the state of the market. Instead, they suggest looking at the entire LOB to get a more comprehensive view of liquidity.

Their measure of liquidity, which they call the “liquidity imbalance,” is based on the imbalance between the supply and demand of liquidity in the LOB. This is calculated as the difference between the volume of limit orders on the buy side and the sell side of the book.

The authors then investigate the predictive power of this liquidity imbalance. They find that it can predict future price changes, suggesting that it can be used as a trading signal. However, the predictive power is asymmetric: it is stronger for negative price changes than for positive ones.

This study provides a fresh perspective on LOB imbalances. It shows that these imbalances can provide valuable information about the liquidity of the market, which can in turn be used to predict price movements. This adds another layer to our understanding of the potential uses of LOB imbalances in trading.

In the next section, we’ll look at a study that takes a more detailed look at the structure of the LOB and how it can influence price movements.

Queue Imbalance as a One-Tick-Ahead Price Predictor in a Limit Order Book

In this section, we will discuss the paper Queue Imbalance as a One-Tick-Ahead Price Predictor in a Limit Order Book by Hao, Kearns, and Nevmyvaka. This paper takes a deep dive into the predictive power of LOB imbalance, specifically focusing on its ability to predict the direction of the next mid-price movement.

The authors start by introducing the concept of queue imbalance. This is defined as the difference between the number of orders in the best bid queue and the best ask queue, divided by the total number of orders in both queues. In other words, it’s a measure of how much more demand there is than supply (or vice versa) at the best bid and ask prices.

The authors then set out to investigate whether this queue imbalance can be used to predict the direction of the next mid-price movement. To do this, they use a large dataset of LOB data from the NASDAQ exchange, and they build a simple predictive model based on the queue imbalance.

The results of their study are quite striking. They find that the queue imbalance is indeed a strong predictor of the direction of the next mid-price movement. In fact, they find that a trading strategy based on this predictor can generate significant profits, even after accounting for transaction costs.

However, the authors also caution that this result should not be interpreted as a guarantee of profits. They note that the predictive power of the queue imbalance can vary depending on the market conditions, and that it can be influenced by other factors such as the overall market trend and the volatility of the stock.

In conclusion, this paper provides strong evidence that LOB imbalance can be a powerful tool for predicting short-term price movements. It shows that by carefully analyzing the LOB, traders can gain valuable insights that can help them make more informed trading decisions.

Visualizing LOB Imbalances with VisualHFT

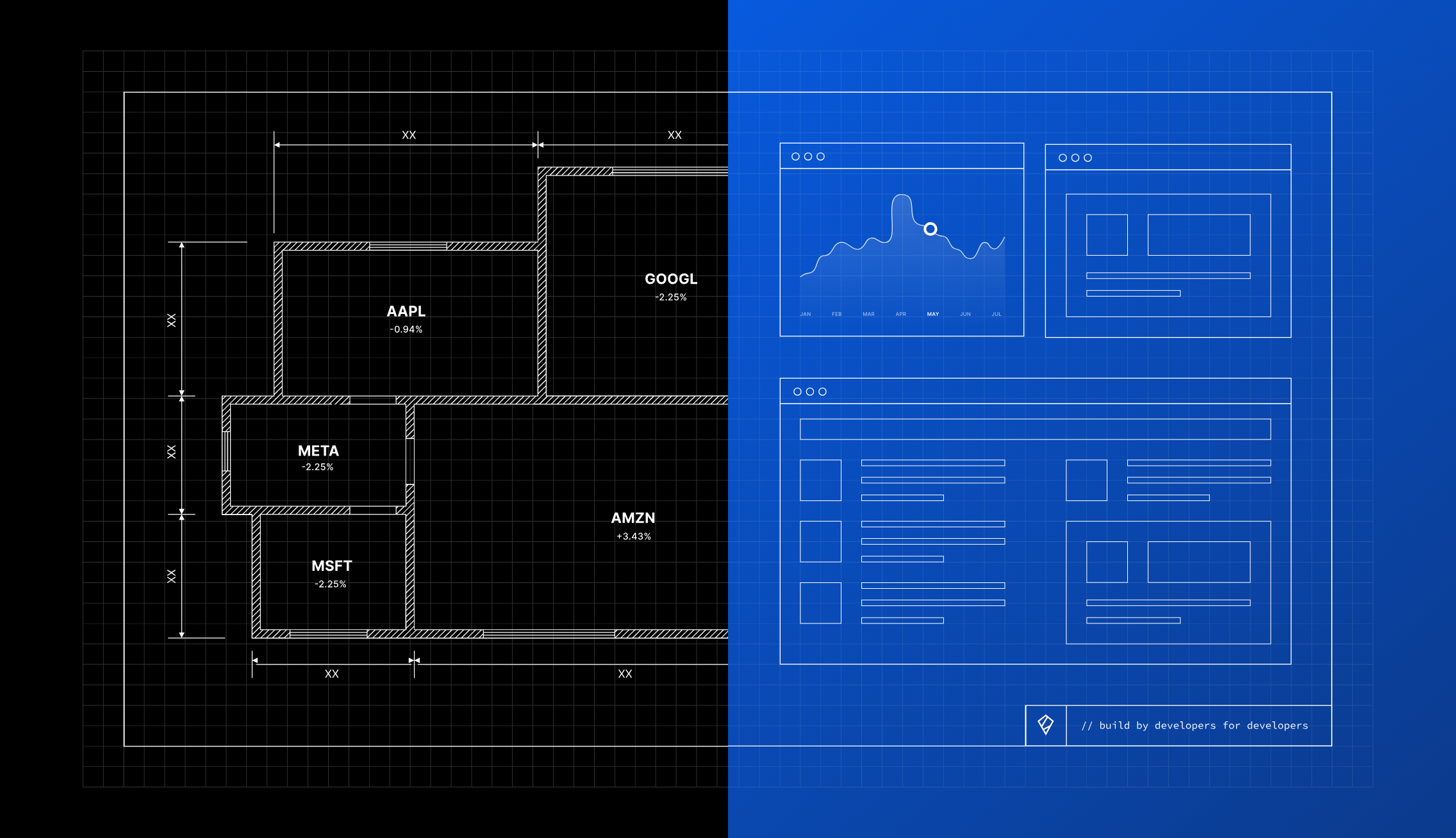

After analyzing the academic world and understanding the importance of LOB imbalances, it’s time to bring these concepts into the practical realm of trading. This is where VisualHFT comes into play. VisualHFT is a GUI for enterprise-level high-frequency trading systems, focusing on visualizing market microstructure analytics, such as Limit Order Book dynamics, latencies, execution quality, and other analytics.

VisualHFT was developed by a software engineer with a decade of experience in building high-frequency trading software. The inception of VisualHFT was driven by a need for transparency and control in high-frequency trading operations. As the core high-frequency trading system operates in a collocated server with minimal human interaction, it was crucial to develop a mechanism that could provide real-time insights into the system’s operations.

VisualHFT provides a real-time view of trading operations, visualizing depth up to 5 levels on each side, displaying real-time market data from many data sources, and providing a visualization of selling/buying orders on the Limit Order Book (LOB). It also shows the user’s orders (market making) and provides a spread chart visualization.

The system operates by receiving a specific collection of JSON messages via WebSocket. These messages contain the real-time trading data that the GUI visualizes. The core trading system, located in the “demoTradingCore” folder, feeds data to VisualHFT. This system must have a REST and WebSocket server and be capable of persisting position data into the database.

VisualHFT was open-sourced with the aim of contributing to the broader trading community and fostering innovation in the field of high-frequency trading. By providing a clear, real-time view of trading operations, VisualHFT enables users to make informed decisions and maintain control over their trading strategies.

Now, let’s discuss how VisualHFT can help traders leverage the insights from the research papers discussed in this article. The studies we’ve explored highlight the importance of LOB imbalances as a predictive tool for price movements. VisualHFT, with its real-time visualization of LOB dynamics, provides traders with a powerful tool to observe these imbalances as they occur.

By visualizing the LOB, traders can see the imbalance between the buy and sell orders and use this information to predict the direction of the next price movement, as suggested by the studies. This can be particularly useful in high-frequency trading, where the ability to make quick, informed decisions can be the difference between profit and loss.

In conclusion, the research papers we’ve discussed provide compelling evidence of the predictive power of LOB imbalances. VisualHFT brings these academic insights into the practical world of trading, providing a tool that allows traders to visualize these imbalances in real-time and potentially leverage them for profit. By bridging the gap between theory and practice, VisualHFT contributes to the ongoing innovation in the field of high-frequency trading.

Conclusion

Having the right tools and insights can make the difference between profit and loss. This article has taken a deep dive into the concept of Limit Order Book (LOB) imbalances and their potential as a predictive indicator for price movements.

We’ve explored three key research papers that shed light on the predictive power of LOB imbalances. The first paper, “Limit Order Book as a Market for Liquidity,” introduced us to the concept of LOB and its importance in understanding market liquidity. The second paper, “The Information Content of the Limit Order Book: Evidence from NYSE Specialist Trading Decisions,” demonstrated the predictive power of LOB imbalances in forecasting short-term price movements. Finally, the third paper, “Queue Imbalance as a One-Tick-Ahead Price Predictor in a Limit Order Book,” provided further evidence of the predictive power of LOB imbalances, even in a high-frequency trading environment.

Bringing these academic insights into the practical world of trading, we introduced VisualHFT, a GUI for enterprise-level high-frequency trading systems. VisualHFT provides a real-time view of LOB dynamics, allowing traders to visualize imbalances as they occur and potentially leverage them for profit.

In conclusion, LOB imbalances offer a promising avenue for predicting price movements in high-frequency trading. The research papers we’ve discussed provide compelling evidence of this, and tools like VisualHFT bring these insights to life, offering traders a practical way to leverage these findings.

We encourage you to delve deeper into the research papers and explore VisualHFT further. In the fast-paced world of high-frequency trading, staying informed and leveraging the latest insights can give you the edge you need.

Learn more about what we do: https://sisSoftwareFactory.com