Professor Chien-Feng Huang, at the National University of Kaohsiung in Taiwan delves into high-frequency trading across Artificial Intelligence

In the past two decades, Prof. Chien-Feng Huang has been working on several lines of interdisciplinary research across Artificial Intelligence (AI) and Finance, including high- frequency trading. His ultimate goal is to discover efficient as well as effective investment and trading models to create a blue ocean strategy in Finance.

Big data technology, data mining and machine learning play key roles in his research because many niches have not been discovered yet or are not even comprehensible by humans currently. Prof. Huang regards this as an outstanding opportunity for AI to assist humans in exploring unknown territories in the investment world. Through AI, Prof. Huang thinks those who trust systematic, effective, reason-based investing strategies shall benefit from the systems he has developed.

Dealing with various financial circumstances for investment and trading

One crucial line of research Prof. Huang has been tackling is to solve the problem of combing contradictory strategies to discover emerging ones to bring about generalized models to deal with various financial circumstances for investment and trading. For example, the momentum investing strategy might advise buying a stock, yet the value investing strategy advises against it.

So, which one is right? Does there even exist a way to further combine the seemingly contradictory strategies to generate new approaches that supersede the old ones? In other situations, it is often that various useless strategies, when working together with further tuning, become a powerful weapon for investment and trading. For such questions, Prof. Huang’s results showed that AI-based methodologies are promising in assisting with solving such problems.

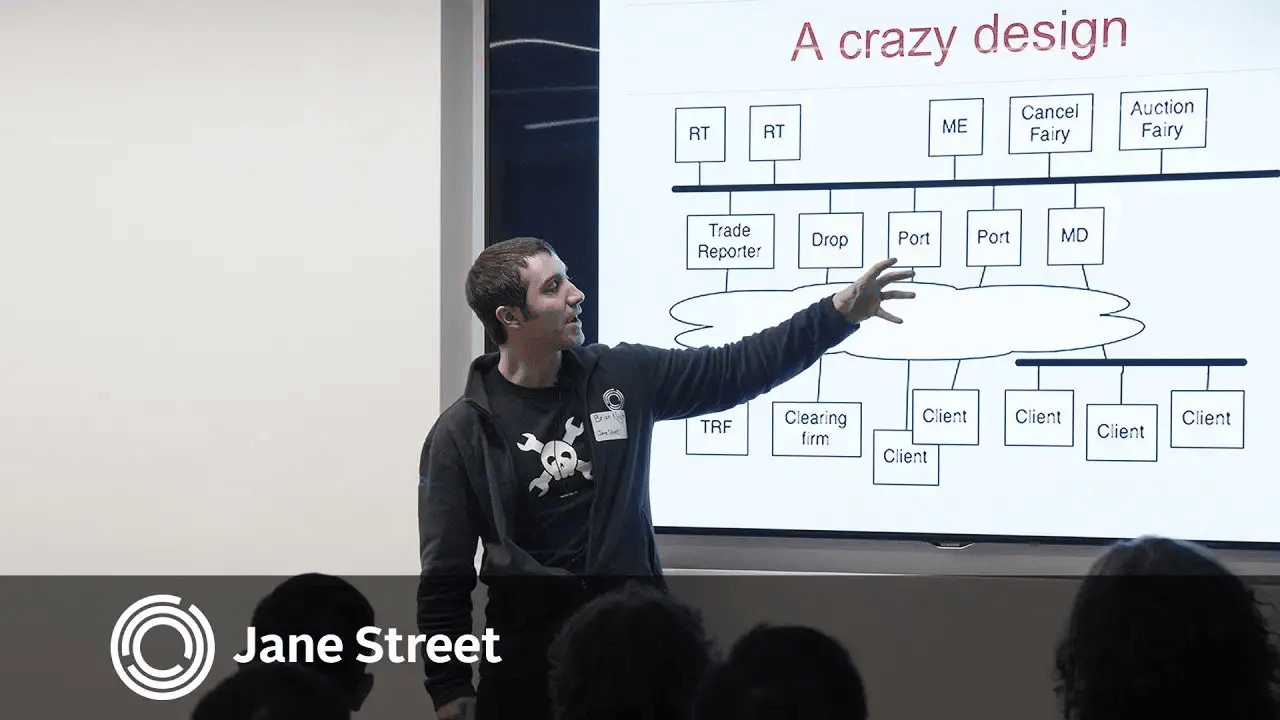

Prof. Huang is also pursuing research into high-frequency trading. The advancement of information technology in financial applications nowadays have led to very quick market-driven events that prompt flash decision-making and actions issued by computer algorithms. The result is that today’s markets experience intense activity in a highly dynamic environment where trading systems respond to others at a much faster pace than before. This new breed of technology involves the implementation of high-frequency trading strategies which generates a significant amount of activity in financial markets and present researchers with a wealth of information not available in traditional low-speed trading environments.

Prof. Huang and his team have been aiming at developing feasible computational intelligence methodologies, particularly genetic algorithms (GA) (1), to shed light on high-frequency trading using information concerning the demand and supply of stocks at the microscopic level.

Genetic algorithms for solving optimization problems

Genetic algorithms (GA) have been used as computational models of natural evolutionary systems and as a class of adaptive algorithms for solving optimization problems. GA operate on an evolving population of artificial agents. Each agent is comprised of a genotype (often a binary string) encoding a solution to some problem and a phenotype (the solution itself). GA regularly start with a population of randomly generated agents within which solution candidates are embedded.

In each iteration, a new generation is created by applying genetic variation, mainly crossover and mutation, to promising candidates selected according to probabilities biased in favor of the relatively fit agents. As a result, evolution occurs by iterating stochastic variation of genotypes and the selection of the best phenotypes in an environment according to how well the individual solution solves a problem. Successive generations are created in the same manner until a well-defined termination criterion is met. The core of this class of algorithms lies in the production of new genetic structures along the course of evolution, thereby providing innovations to solutions for the problem at hand.

What are the steps of simple genetic algorithms?

- Step 1.

- Randomly generate an initial population of l agents, each being an n-bit genotype (chromosome).

- Step 2.

- Evaluate each agent’s fitness.

- Step 3.

- Repeat until l offspring have been created.

- (a) Select a pair of parents for mating.

- (b) Apply variation operators (crossover and mutation).

- Step 4.

- Replace the current population with the new population.

- Step 5.

- Go to Step 2 until the terminating condition.

In Huang’s model, a slightly advanced version of GA is proposed to solve high-frequency trading and forecasting problems. For instance, Huang et al. (2) proposed to use binary strings to encode model parameters and baseline rules as shown in the above figure.

In particular, the proposed model intends to consider the disclosed quotes for the bid and ask prices and volumes of stock as well as certain baseline rules as the inputs to the GA-based model to predict the direction of future price movement. As a matter of fact, the goal of the proposed strategy is to model the extent of the demand and supply for stocks. Huang’s results show that a more advanced GA-based system than the ones in (2) can significantly improve the accuracy of the prediction for price movement, and it is thus expected this GA-based methodology to advance the current state of research for high-frequency trading.

References

1. J. H. Holland, Adaptation in Natural and Artificial Systems, University of Michigan Press, Ann Arbor, Mich, USA, 1975.

2. C.-F. Huang, H.-C. Wu, P.-C. Chen and B. R. Chang, Autonomous self-evolving forecasting models for price movement in high frequency trading: Evidence from Taiwan. Intelligent Data Analysis 24 (2020), pp. 1175– 1206.

Please Note: This is a Commercial Profile

Source: High-frequency trading through artificial intelligence for financial innovation