As we navigate the fast-paced world of quantitative finance, we often find ourselves balancing on a tightrope, juggling complex mathematical models, evolving market dynamics, and a continuous influx of data. Both for newcomers and seasoned quants, trading strategy development presents an intricate puzzle. Yet, the very challenges that make it daunting also make it a riveting and rewarding field.

The Learning Curve

For those stepping into the world of quantitative finance, the steep learning curve is usually the first challenge encountered. With roots buried deep in mathematics, statistics, computer science, and finance, mastering the fundamentals requires dedication and patience. Furthermore, the evolution of machine learning and artificial intelligence has added yet another layer of complexity to this already intricate field.

But fear not. Every accomplished quant was once a beginner too, and they climbed this steep slope by committing themselves to consistent learning and practice. Remember, the path to expertise might be long, but it’s the journey that fosters growth.

The Education Gap

The education gap poses a unique challenge to aspiring quants. While traditional finance programs provide a broad overview, they may not delve into the intricate details of quantitative finance. Self-learning resources might be abundant, but they often lack the structure, coherence, and thoroughness needed for a robust understanding. The challenge, therefore, lies in finding educational material that is both comprehensive and comprehensible.

The Tooling Deficit

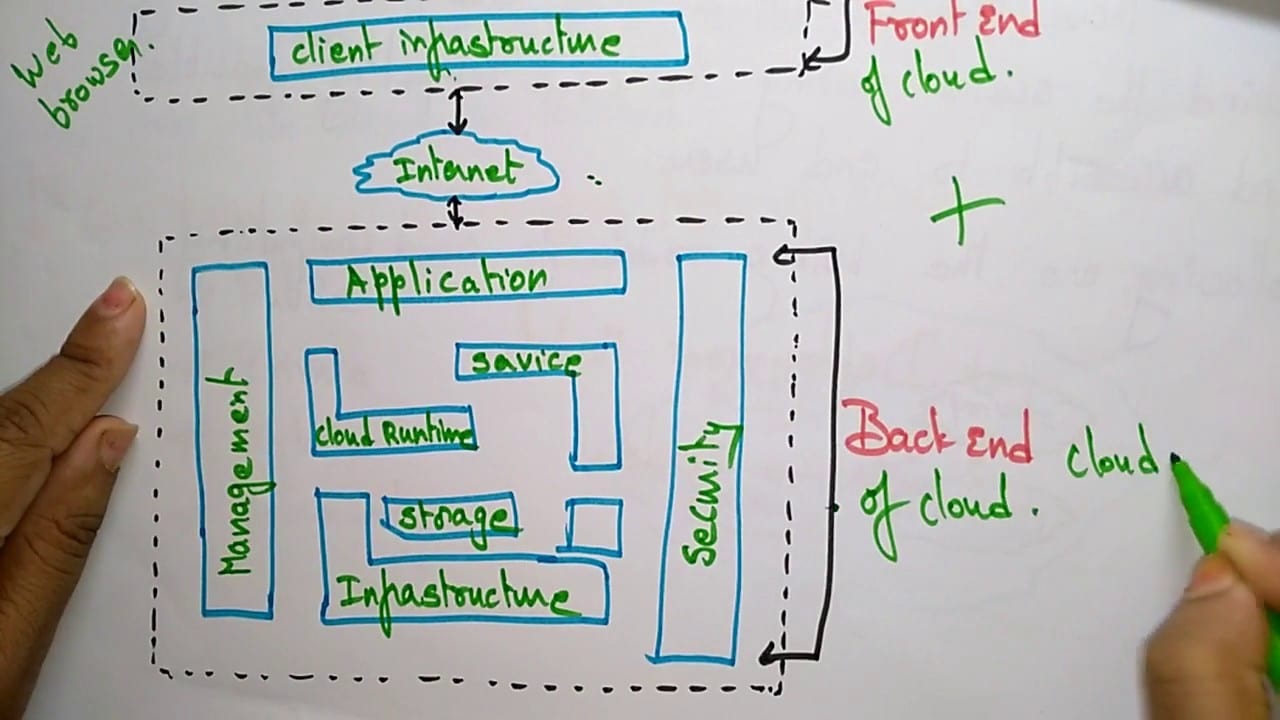

A crucial component of quantitative finance is the software tools and platforms used to develop and implement trading strategies. An aspiring quant is expected to be a jack-of-all-trades, with proficiency in programming languages like Python, R, or MATLAB, and familiarity with APIs for data extraction and trading.

However, the lack of user-friendly, high-quality tools is a notable pain point. Even as software evolves, the learning curve remains steep, and the gap between coding skills and strategy implementation continues to pose challenges. This is one of the core issues we strive to address here at Hudson & Thames with out suite of tools: MLFinlab, ArbitrageLab, and PortfolioLab.

Navigating the Data Jungle

The modern financial landscape is characterized by a deluge of data. While this data-rich environment opens doors to novel insights and strategies, it also presents a daunting task: extracting meaningful information from a vast, often chaotic sea of data.

In this scenario, data handling, pre-processing, and feature engineering become significant challenges. The computational requirements for storing and analyzing vast quantities of data further intensify the complexity.

But it’s not just about quantity. High-quality data is a problem that many quants encounter. This is because high-quality data is often expensive and difficult to obtain. To tackle this problem, firms are employing innovative techniques to handle, process, and extract meaningful information from multiple data sources.

Dealing with Market Noise

Market noise—the random price fluctuations that obscure the underlying trend—is another hurdle that quants face. Disentangling signal from noise demands sophisticated statistical techniques and deep domain knowledge. An effective trading strategy should account for market noise and avoid overfitting, a common pitfall that occurs when a model is too closely tailored to past data and performs poorly on new data.

The Road to Overcoming Challenges

Despite these hurdles, the future of quantitative finance shines bright, as do the prospects for aspiring quants. For every challenge, there’s an emerging solution. From democratizing access to financial education to developing robust, user-friendly tools, the landscape is evolving rapidly.

Education platforms are mushrooming, offering comprehensive and structured materials to bridge the knowledge gap. Companies are investing in world-class quantitative algorithm tooling to counter the tooling deficit, providing state-of-the-art libraries that simplify strategy development and implementation.

To address the data challenge, firms are employing innovative techniques to handle, process, and extract meaningful information from raw data. Additionally, they’re creating educational materials and tools to help quants better understand and utilize these techniques.

In conclusion, it’s an exciting time to dive into quantitative finance. The road might be paved with challenges, but every step forward—every problem solved and every skill honed—takes you closer to your goal. Embrace the journey, and let the trials you face become stepping stones to your triumphs in the field of quantitative finance.

Orignal post: Challenges in developing trading strategies in quantitative finance